FOCUS Legislative Review 2017/Preview 2018

Download the PDF Version

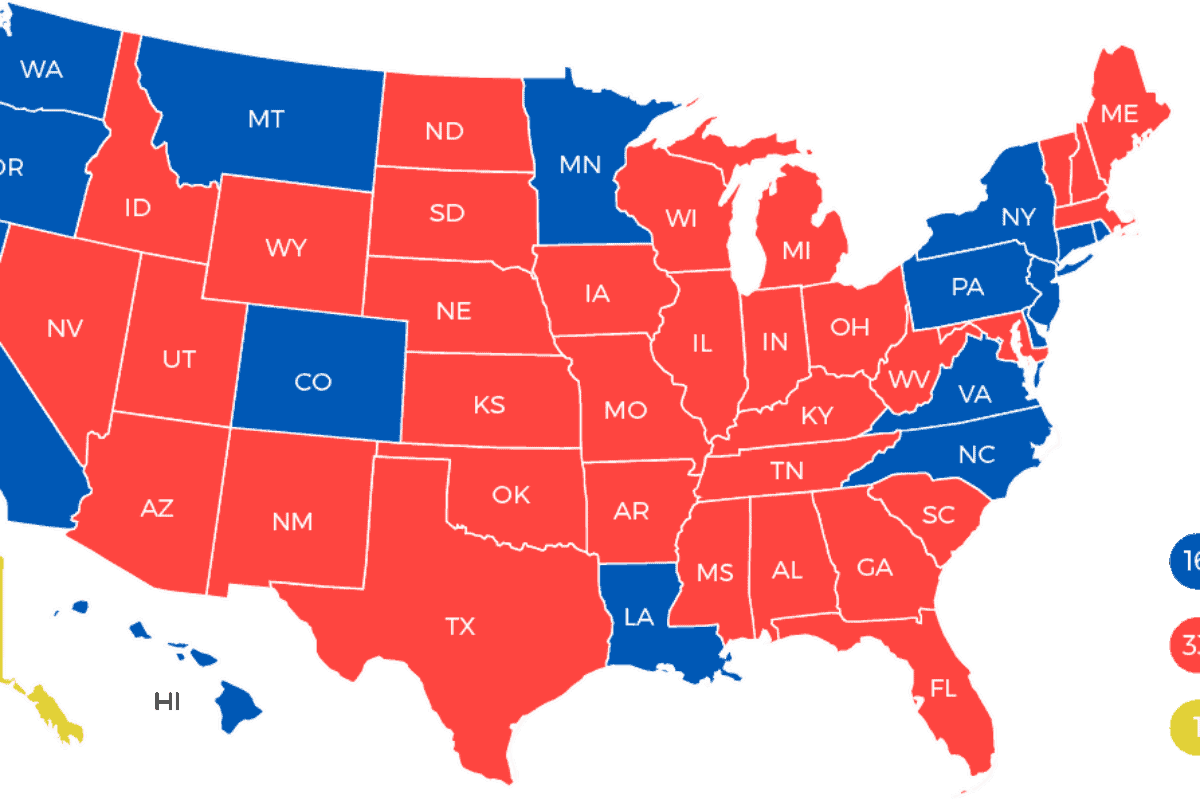

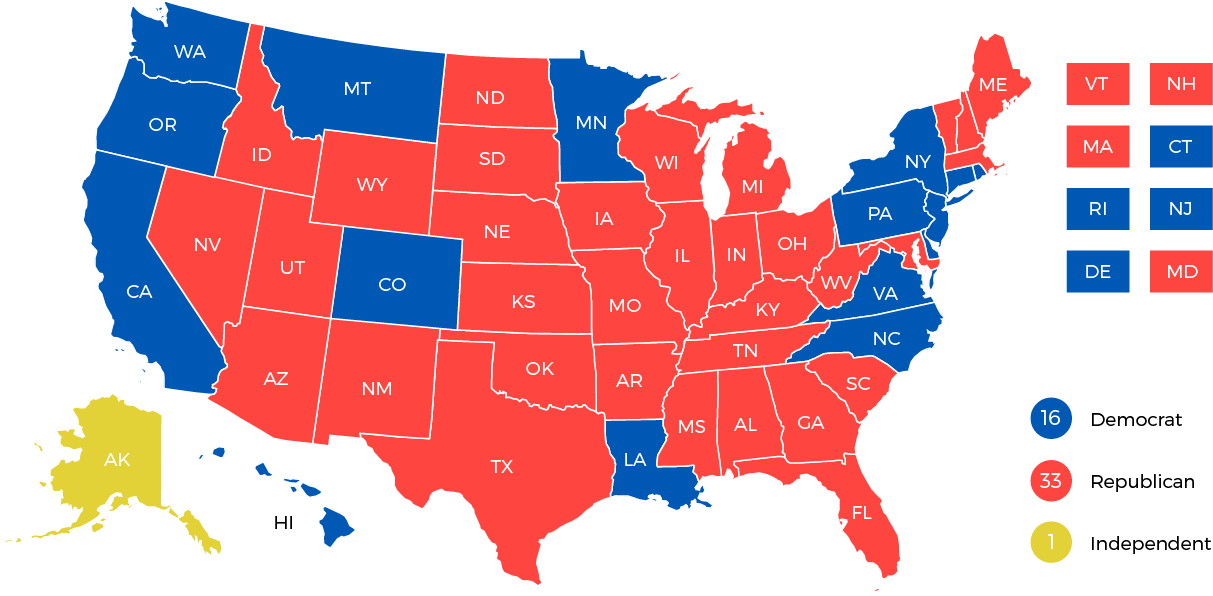

With uncertainty at the federal level continuing into 2018, states will once again direct their focus on responding to federal challenges as they arise and continue to participate in many nationwide policy debates on issues ranging from healthcare to privacy. While Republicans hold the governor’s office in 33 states, soon to be 32 with the inauguration of New Jersey Democratic Governor-elect Phil Murphy on January 16, and control 67 legislative chambers; 2017 will be remembered for the noteworthy electoral success of Democrats at the state level, including the election of Democratic governors in New Jersey and Virginia, and the near-flipping of party control in the Virginia House of Delegates.

Gubernatorial Party Control

Much like 2017, the 2018 state policy landscape will continue to be driven by actions at the federal level, with healthcare, marijuana policy and net neutrality chief among them. This report will examine the key policy areas that are likely to take center stage in state capitols across the county in 2018.

Autonomous Vehicles

Automated systems such as anti-lock brakes have been in the vehicles we drive every day since the 1950s and power steering was patented back in 1900. The majority of new cars on the road contain over 100 computer systems controlling even the most basic of functions – including power windows, backup cameras, starter buttons and more.

States are working independently to legislate what the future of autonomous vehicles will look like. NCSL reports that 21 states and the District of Columbia have passed some sort of legislation related to autonomous vehicles, those states being Alabama, Arkansas, California, Colorado, Connecticut, Florida, Georgia, Illinois, Louisiana, Michigan, Nevada, New York, North Carolina, North Dakota, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Vermont and Virginia.

Autonomous vehicles are not only being considered for use in public transportation, but also for goods and services. Truck platooning allows driverless tractor-trailers to follow one another using automated speed and spacing controls, according to the Federal Highway Administration.

Committees and study groups are continuing to form across the country to study the next steps. The California DMV is currently working on regulations to govern both the testing and public use of autonomous vehicles, required by the Autonomous Vehicle Law, which was passed in 2014. A bill in Florida, HB 535, would create a statewide alternative transportation authority to regulate autonomous vehicles and transportation network companies. Maine LD 1724 would allow municipalities to develop, test and operate a pilot program for the use of autonomous vehicles for public transportation. New Mexico SJM 3 would request the Department of Transportation create and lead an autonomous vehicle committee to review the current and developing technology and relevant existing state policy. Pennsylvania SB 1267/Chapter 101 allocates up to $40 million for intelligent transportation system applications, such as autonomous and connected vehicle-related technology. New Hampshire HB 1459 would prohibit the operation of autonomous vehicles all together, while Tennessee SB 598 prohibits local governments from banning the use of vehicles equipped with autonomous technology.

Federally, it’s been established that the vast majority of serious crashes are due to human error, and if technology can eliminate that, it’s a necessity. In September 2017, the National Highway and Transportation Safety Administration (NHTSA) released new federal guidance for Automated Driving Systems, A Vision for Safety 2.0, which establishes that the NHTSA is “committed to advancing this technology in order to eliminate motor vehicle-related deaths on America’s roads.”

There are still many unknowns in the world of partially and fully autonomous vehicles, beyond the question of how to determine responsibility in the instance of a crash. State and federal action and discussion on autonomous vehicles is expected to continue throughout 2018, with topics including the impact of such vehicles on the insurance industry, data privacy laws and their effect on law enforcement and police patrol.

Data Privacy and Security

In the face of federal uncertainty and several high profile security breaches, data privacy and security will once again feature prominently at state capitols nationwide. As consumers clamor for more control over how their data is shared with third parties, state lawmakers will look to add to an immense patchwork of existing state privacy laws.

Data Privacy

In California, proponents of a ballot initiative, called the California Consumer Privacy Act of 2018, are looking to get the initiative up for consideration during the 2018 elections. According to the Los Angeles Times, the initiative would require a business, upon request, to disclose the types of personal information they collect and provide consumers the ability to refuse the sale of their information.

After Republican President Donald Trump decided to repeal broadband privacy rules, a move that proved controversial, many states attempted to fill the void. Since the rules were officially repealed last April, states have filed bills in an attempt to restore the previous federal standard. States with newly introduced internet service provider (ISP) privacy legislation include Florida, where SB 1854 was prefiled on January 5, and Kentucky, where SB 11 is currently pending in the Senate Natural Resources and Energy Committee. In Vermont, three senators including President Pro Tempore Tim Ashe, D-Burlington, introduced SB 289, which is currently pending in the Senate Finance Committee.

Vermont will also be taking another look at the issue of data brokers following the issuance of a report from the state attorney general. A proposed bill draft that is currently being discussed would define “data broker” as a commercial entity which assembles, collects, stores or maintains personal information concerning individuals who are not customers or employees of that entity, and then sells the information to third parties. House Commerce and Economic Development Committee Chair Bill Botzow, D-Bennington, has stated that this issue is among his legislative priorities, VTDigger.org reports.

Data Security

With the Equifax security breach still fresh on the minds of state lawmakers, many states will be considering changes to their data breach laws in 2018. At present, 48 states have a data breach law on the books with the latest being New Mexico, which enacted HB 15/Chapter 36 in 2017. States that will be considering data breach legislation in 2018 include California, Connecticut, Florida, Georgia, Illinois, Indiana, Kansas, Kentucky, Maine, Massachusetts, Michigan, Minnesota, Missouri, New Hampshire, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Vermont, Virginia, Washington and Wisconsin, as well as the District of Columbia.

The New York Department of Financial Services adopted first-in-the-nation cybersecurity regulations that took effect last August. The regulations require banks, insurance companies and other financial service institutions regulated by the department to have a cybersecurity program designed to protect consumers’ private data, a written policy or polices that are approved by a senior officer or covered entity’s board of directors, and a chief information security officer to help protect data and systems. Covered entities must report cybersecurity events to the department through the department’s online cybersecurity portal. Covered entities can also use the portal to file notices of exemption, which are due within 30 days of determination that the covered entity is exempt.

Pennsylvania HB 1846, which was carried over from the 2017 session and has bipartisan support from several House members, would require notice to consumers of a security breach within 45 days but notice to the attorney general within 30 days.

Infrastructure and Transportation

America’s infrastructure is crumbling. The projects that came about from an increase in development spending post World War II are in desperate need of repair or replacement. While federal money is important for the development of new projects, states foot a larger part of the bill and they own the cost of maintenance. State and local infrastructure spending accounts for roughly 75 percent of the capital needed for projects and maintenance. Infrastructure spending is down across the board; federal and state spending as a percentage of GDP is at the lowest it has been in 30 years, according to the Center on Budget and Policy Priorities.

With the predictability of federal funding remaining uncertain, states have been getting more creative with ways to help fill the funding gap. Data from Transportation for America shows that 31 states have established plans to raise additional transportation funding since 2012. States have increased fees and taxes on a number of transportation related expenses such as gas taxes, tolls, and vehicle and license fees. Gas tax took the headlines in 2017 with increases in California, Indiana, Michigan, Montana, Oregon, South Carolina and Tennessee. We expect states around the country to use similar strategies to help fill their transportation coffers in 2018 and address the critical needs of their aging infrastructure systems.

Healthcare

Throughout 2017, a shadow continuously loomed over the direction of federal healthcare policy regarding a promised repeal and replace of the Affordable Care Act (ACA) by the Trump administration. As part of a last-minute effort, Congressional Republicans were able to squeeze a provision eliminating the ACA’s unpopular individual mandate into H.R. 1, the “Tax Cuts and Jobs Act.” Further, the Trump administration took unilateral action to withhold payments, known as Cost Sharing Reduction payments (CSRs) to health insurance providers. The loss of CSR payments, in tandem with the elimination of the individual mandate, is likely to cause chaos in state individual insurance marketplaces, where premiums are expected to spike. Bloomberg reports that a settlement between the Trump administration and a number of Democratic attorneys general could pave the way for continuance of the CSR payments, though an ultimate resolution to the issue remains unclear.

On September 30, a popular state-federal program that provides health insurance to children, the Children’s Health Insurance Program (CHIP), was allowed to expire without reauthorization. If not reauthorized by Congress, the question of which is currently being debated, states will need to make critical decisions on whether to pick up this tab themselves, further cramping already tight budgets, or to drop coverage altogether. The Kaiser Family Foundation reports that states are expected to begin running out of money for the program in January, with most exhausting their funds by April. The program covers 8.9 million children across the nation.

It is from this lens of uncertainty that state legislators must view the most important state-level health policy decisions in 2018. States will need to be quick to react to any sudden changes in federal policy, a difficult task for state legislatures, where most meet only part time and tend to move much more slowly and deliberatively on policy issues than their federal counterparts.

Prescription Drug Pricing

While the issue of prescription drug pricing began to bubble up in 2016 amid outrage over once-inexpensive prescriptions such as EpiPen rising exorbitantly, the heat greatly rose on pricing in 2017, as states began to react in earnest to the developments of 2016. In 2018, we expect the issue to gain even more traction, likely reaching a full boil in 2019, following the 2018 midterm elections.

In legislative chambers around the nation, states have been begun putting pressure on drug manufacturers, health insurers and pharmacy benefit managers to disclose prescription drug costs and what factors are associated with determining a price. From 2015-2017, these types of bills have taken state capitals by storm; 28 states have considered such bills according to NCSL, while seven states have enacted them. Because prescription drug prices have been hammering state budgets indiscriminately, the issue has transcended party lines. Among those that have enacted such pricing disclosure bills are deep-red Texas and, its ideological opposite, Vermont. These trends are undoubtedly expected to pick up further steam during the 2018 legislative session, as budgets tighten due to increased healthcare costs and the federal government footing less of Medicaid expansions.

Meanwhile, individual states have looked to other methods on curbing pharmaceutical costs. California and Ohio both attempted to regulate drug prices through ballot initiatives, which would have required state agencies to pay no more for a drug than the U.S. Department of Veteran Affairs. Voters in both states failed to pass these measures.

Deep-blue Massachusetts’ Republican Gov. Charlie Baker has proposed major reforms to the state’s Medicaid system and how prescription drugs are covered under it. In a first-of-its-kind proposal, Governor Baker has requested federal approval for MassHealth, the state’s Medicaid program, to create its own formulary – a specific list of drugs covered by the program. The program, which is currently awaiting federal approval, aims to significantly cut prescription costs by prioritizing low-cost alternatives and generics over more expensive brand-name prescription drugs.

Insurance Across State Lines

The ability for insurers to sell health policies across state lines is a policy that has been discussed at both the state and national levels for a number of years, yet has never quite broken into the national spotlight as a key health policy issue. At the federal level, it has been discussed and included in a number of Republican proposals related to repealing and replacing the ACA, and has also made small headway in state legislatures. The ACA itself permits the creation of interstate pacts that would allow such sales, subject to approval by the states and the U.S. Department of Health and Human Services.

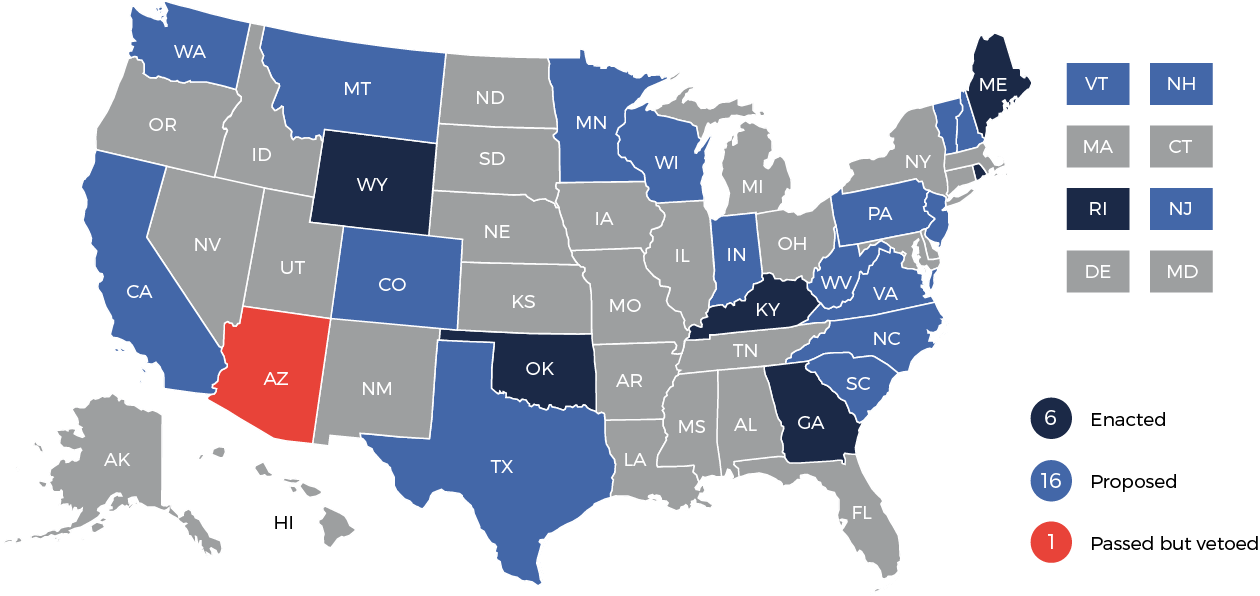

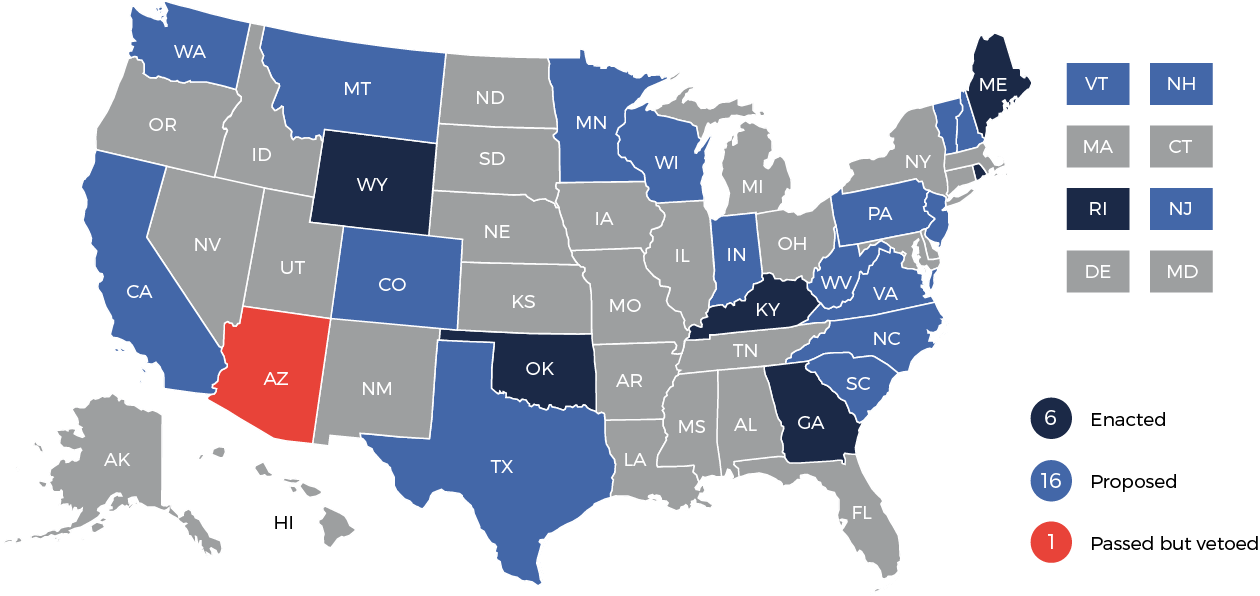

Over the past 10 years, six states have passed laws allowing such sales, while an additional 17 have considered bills, according to NCSL. Despite states passing these laws, insurers have shown no appetite for it; no insurer currently offers these policies in any of the six states where it is permissible. The National Association of Insurance Commissioners has come out strongly against the policy, arguing that it would severely damage insurance markets and lower the quality of products available to consumers.

President Donald Trump reignited the issue in October when he signed an executive order seeking to expand access to certain types of health plans across state lines. While this move may embolden state legislators to take up the issue in 2018, successful implementation will require the crafting of policy that is palatable to insurers.

Medicaid Expansions

In 2017, Maine voters became the first to approve the ACA’s Medicaid expansion through ballot initiative, after Republican Gov. Paul LePage had vetoed bills passed by the state legislature five times, according to The New York Times. Maine may be the first in a row of states initially opposed to expansion that begin to acquiesce in 2018, depending on the results of the 2018 midterm elections. To date, 32 states and the District of Columbia have accepted the expansion, while 18 have not, according to the Kaiser Family Foundation.

Gradual tapering of fiscal coverage for the expansion means that the burden on state budgets will only continue to grow as the federal government cuts back and health care costs continue to rise at an alarming rate. While this fiscal risk continues to push conservative states away from the expansion, the shadow of Maine’s voter-approved expansion threatens to take away certain policy decisions from state legislators.

Activists in non-expansion conservative states are eyeing ways to get the proposal, which is widely popular among the public, on the ballot, according to Forbes. While some conservative states, such as Indiana, have been able to pass so-called “alternative expansions” that require certain individuals to pay monthly premiums or employment requirements in order to qualify, an initiative-approved expansion could eliminate these options for lawmakers in conservative states that have not yet expanded, sticking them with the traditional, more expensive version of the expansion. Interest groups in Idaho, Nebraska and Utah are taking steps to get the measure on the ballot in 2018.

In Florida, the state with the third-highest number of uninsured citizens, two proposals to expand Medicaid have already been prefiled. Deep-red Kansas narrowly missed overriding Republican Gov. Sam Brownback’s veto of a Medicaid expansion bill; lawmakers in the state will likely make another attempt in 2018. Virginia will again be the state where the debate for expansion is the fiercest, and the most likely to prevail. Democratic Gov. Terry McAuliffe has attempted for years to expand the program, only to come up a few votes shy in the House during his last attempt in 2017. Democratic Governor-elect and current Lieutenant Governor Ralph Northam has pledged to expand the program, and may well be able to given the new power dynamics in the General Assembly.

Education

Education Funding

The debate over funding levels and mechanisms for public education is revisited each year in state capitols around the country. As states contend with rising costs, a substantial array of federal mandates and an ever expanding list of education priorities, the debate in 2018 will likely center around equity of funding. Major legal challenges to education funding models over equity concerns added an element of urgency to the 2017 debate in Connecticut, Iowa and Kansas. In response to legal challenges and budgetary issues, each of these states will need to revisit their education funding models comprehensively. Democratic Gov. Dannel Malloy’s budget office has indicated in a letter to all state agency leaders that substantial budget cuts will be necessary in fiscal year 2019. While the case surrounding Iowa’s education model was dismissed, the Des Moines Register reports that proposals to create an Education Savings Account program to mitigate education inequalities in the state, which stalled in 2017, are expected to be taken up again in 2018.

In 2017, eight states enacted legislation to either create or expand parental choice programs. The legislation was introduced but died in 11 states, and proposals are pending in 13 states. U.S. Secretary of Education Betsy DeVos has made the expansion of school choice programs a policy priority, and such proposals could have political momentum in conservative states in 2018.

States also grappled in 2017 with the management and oversight of privately managed charter schools. Charter school legislation was enacted in 17 states, and is pending in 18 more. Chalkbeat reports that legislation recently introduced in Indiana with bipartisan support would create new oversight requirements for charter school organizers to demonstrate that students are learning as a condition of charter renewal. According to the Center for Education Reform, 43 states and the District of Columbia have enacted laws authorizing charter schools.

Education Standards

In 2018, states will work toward finalizing their education plans under the federal Every Student Succeeds Act (ESSA) of 2015. The act rolled back much of the federal footprint in accountability that was present under the No Child Left Behind Act of 2001 and gives states more flexibility to create accountability systems that suit their individual needs. U.S. News and World Report reports that the elimination of Obama-era federal regulations by the U.S. Department of Education aimed at providing guidance to state departments of education on implementing the law have complicated the process of creating and implementing state plans under ESSA.

The New Mexico Department of Education will revise its proposal for new science and teaching standards that would have removed concepts related to climate change, evolution and the age of the Earth, the Albuquerque Journal reports. The department has indicated that it will adopt the Next Generation Science Standards in their entirety, with the addition of six state-specific science standards. The National Science Teachers Association reports that 19 states and the District of Columbia have adopted the standards. New Hampshire enacted SB 44/Chapter 252 in July 2017, which prohibits the state from requiring implementation of the Common Core State Standards by local districts and requires legislative oversight of future amendments to academic standards by the Department of Education. The state remains in the Common Core consortium along with 41 other states and the District of Columbia, but the decision to implement the standards will now be made at the local level.

2017 saw states expand dual enrollment and early college programs, which allow high school students to take courses for concurrent high school and college credit. Eighteen states enacted legislation that modified or expanded dual enrollment programs in 2017, and such legislation is pending in 19 states. According to the Brookings Institution, 47 states have laws or rules governing dual enrollment. Policymakers will continue to pursue dual enrollment as a means to increase college attainment and cut the overall cost of higher education. States will also continue work on policies governing how credit earned in concurrent enrollment courses and by examination through Advanced Placement, Cambridge International and International Baccalaureate programs may be transferred to institutions of higher education. In 2017, universal transfer and articulation policies were enacted in New Mexico and Tennessee, while Washington enacted a uniform Advanced Placement credit transfer policy. Legislation pertaining to articulation agreements and credit transfer policies is pending in 13 states.

Student Privacy

The Data Quality Campaign, a nonprofit advocacy group that aims to increase public understanding of the value of education data, released its 2017 legislative summary on September 27, EdScoop reports. The report, which can be accessed here, summarizes 2017 legislative activity in certain key areas related to student privacy. In 2017, 36 states introduced 95 bills and passed 31 new laws addressing the collection, linking and governance of education data. Twenty new laws were enacted about publicly reported data on schools and student outcomes, and 30 laws were enacted about how a state provides appropriate access to data for families and educators. Twenty-six states introduced 56 bills and passed 21 new laws addressing state, district and educator needs to make data use possible.

Five states – Arizona, Illinois, Maine, Nebraska and Texas – enacted legislation based on California’s landmark 2014 Student Online Personal Information Protection Act. Those laws create a thorough outline of the permissible uses of student data by schools, districts and third party service providers. As the broader debate over the permissible uses and collection methods of consumer data simmers in 2018, states are expected to continue refining the legal and regulatory framework surrounding student data. NCSL reports that states have taken a variety of approaches to strike a balance between protecting students’ digital privacy and refrain from impeding the educational opportunities presented by technological advances in the digital age.

Net Neutrality

Since the Federal Communication Commission’s decision to overturn the former net neutrality rules on December 14, several states have filed bills, including California, Georgia, Illinois, Massachusetts, Missouri, New Jersey, New Mexico, New York, Rhode Island, Virginia and Washington, which would require ISPs to comply with net neutrality standards or ban internet “fast lanes.” Other states are expected to follow. The FCC issued its final text regarding their ruling on January 3.

On January 9, U.S. Sen. Ed Markey, D-Massachusetts, announced in a press release that his Congressional Review Act (CRA) resolution declaring the disapproval of the FCC repeal reached 43 co-sponsors. The CRA needed 30 members to force a Senate floor vote to attempt to overturn the FCC decision. Republicans have been working to solidify the FCC repeal through federal legislation introduced by U.S. Rep. Marsha Blackburn, R-Tennessee. H.R. 4682, the “Open Internet Preservation Act” would make it illegal to “block lawful content” or “impair or degrade lawful internet traffic” but would not prohibit ISPs from imposing a fee on websites or giving certain sites priority. H.R. 4682 would also preempt any state legislative action.

Net neutrality advocates are looking to take legal action, including New York Attorney General Eric Schneiderman who has said he will lead a multi-state lawsuit to block the repeal. Illinois, Massachusetts, Missouri, New Mexico, Oregon, Virginia and Washington have joined the suit. It is likely other states will join, since 18 state attorneys general already submitted a letter encouraging the FCC to delay the vote. Some of the world’s largest websites are planning to sue the FCC as soon as the final ruling goes into effect, which will be at the time it is posted in the federal register, according to recode.net.

Digital Goods/Streaming Taxation

States continue to introduce legislation that would expand their sales taxes to digital goods and services; however, there continues to be significant differences from state to state in how such goods and services are taxed. Some states have alternative tax regimes where application of their taxes to such goods and services is unclear. A few states have specifically exempted digital goods and services. New tax efforts often result from adapting current laws to cover streaming services and digital goods, as illustrated by proposed legislation below.

Consumer tax groups and tech trade organizations have voiced their opposition to such taxes, warning they can be unfair and deter innovation, reports USA Today. However, state and local governments are attempting to recoup revenue lost from falling pay-TV subscriptions and video rentals, which has translated to fewer funds from taxes on cable bills or charges of sales tax at a cash register. Sales tax revenue last year grew less than one percent, after accounting for inflation, and states are facing slow growth into 2018.

Some of the notable efforts during 2017 include Arkansas HB 1162/Act 141, which imposes the gross receipts tax on digital codes and specified digital products sold to a purchaser who is an end user and with the right of permanent use or less than permanent use granted by the seller, regardless of whether the use is conditioned on continued payment by the purchaser. Alabama put together a Digital Goods Working Group, which then tasked the Department of Revenue with drafting legislation that did not reach introduction in 2017 due to an impasse among legislative leaders and stakeholders. It is possible these efforts could be renewed for 2018. Lawmakers in Florida, Louisiana and West Virginia considered legislation surrounding various forms of taxation of digital goods and services, some which included taxation on the streaming and downloading of digital products; however, these states failed to pass this legislation during 2017. Additional information on 2017 efforts is available in this NCSL presentation that was published on June 15.

Developments to watch in 2018 include Arizona HB 2056, which would subject digital property to the transaction privilege tax in the state, as well as California AB 252, which would temporarily prohibit cities and counties from imposing a tax, including local sales and use taxes and utility user taxes, on video streaming services. According to The Atlanta Journal-Constitution, Georgia lawmakers are proposing a new tax on phone lines, TV subscriptions and potentially upon internet streaming services such as Netflix and Amazon Prime Video. Existing franchise fees on communication services would be eliminated and replaced by the telecommunications tax. According to WTOP, some cities and municipality groups in Virginia are asking state lawmakers to apply the five percent Communications Sales and Use Tax to streaming service subscriptions such as Netflix and Spotify, advocating that this application would increase local tax revenue.

Electronic Notary and Documentation

As technology rapidly changes the business landscape, states will continue to consider legislation that can accommodate traditional professions with modern workflows. Notaries public witness transactions vital to business operations and preserve the integrity of the transaction with a notarized document. Notarial acts include taking an acknowledgement, administering an oath, witnessing a signature or certifying a copy or act. Notaries public must adhere to state standards such as determining and certifying, either from personal knowledge or from satisfactory evidence, that the person appearing before the notary is the person signing a document. The notarial act must be evidenced on a certificate signed and dated by the notary and accompanied by an impression of an official seal or stamp. This practice has traditionally been required to be done in person and with paper documents but technological developments such as electronic signatures and remote identity proofing via webcams have created the opportunity for states to update their laws in order to provide accommodation for a form of electronic notarization.

As of February 2017, at least 24 states have laws that allow for some form of electronic notarization, according to Notary Public Administrators. Nevada, Ohio and Texas enacted legislation during the 2017 session that allows for webcam notarization, reports the National Notary Association. Numerous states have modernized their notary laws by enacting the Revised Uniform Law on Notarial Acts (RULONA) or similar legislation. RULONA was approved by the National Conference of Commissioners on Uniform State Laws in 2010 and is designed to modernize and clarify law governing notaries public with respect to electronic records. RULONA works together with the Uniform Transactions Act, the federal Electronic Signatures in Global and National Commerce Act, and the Uniform Real Property Recording Act to harmonize treatment of notarization of all records, whether paper or electronic. In 2018, states will continue to consider RULONA and similar legislation as a means of facilitating the notarization of electronic records and expanding the use of electronic communications and records in commercial transactions.

Marijuana

According to NCSL, currently 29 states, spanning nearly every region of the country have laws allowing some form of marijuana liberalization, with eight of those states permitting full recreational use for individuals over the age of 21. Recreational and medical marijuana are legal in the District of Columbia, but Congress currently blocks recreational commercial sale. Puerto Rico also has legalized medical marijuana. Another 17 states allow low-THC high-cannabidol products to be used for medical purposes.

Regardless of state initiatives to legalize the medicinal or recreational use of marijuana, the drug remains illegal under the federal Controlled Substances Act. Some financial institutions that have attempted to openly service the marijuana industry have been denied backing by the Federal Reserve and many have also had a difficult time obtaining sufficient insurance coverage and face higher premiums. NCSL estimates that out of more than 12,000 federally regulated banks and credit unions, only about 350 currently service the marijuana industry, leaving most state-sanctioned marijuana businesses operating as cash-only enterprises due to the lack of access to financial services.

Several startup companies have emerged that aim to help eliminate some of the cash transactions amongst marijuana related businesses, including CanPay, which transfers customers’ funds from their bank account to a Colorado-based credit union called Safe Harbor Private Banking, with which dispensaries maintain an account. CanPay is now available to retailers in Colorado, Oregon and Washington and used by Hawaii medical dispensaries, making it the first state to adopt a solely digital transaction process for marijuana purchases, according to Bloomberg. Some marijuana businesses have turned to bitcoin to perform cash-free transactions, as the cryptocurrency is inexpensive and does not require a bank account; however, at least one state – Washington – has attempted to ban the use of bitcoin for marijuana purchases.

On January 3, U.S. Attorney General Jeff Sessions announced the federal government’s retraction of previous protections and guidelines put in place by the Obama administration for state-legal marijuana operations. Sessions’ memo notes that the cultivation, possession and distribution of marijuana may serve as the basis for the prosecution of other crimes, such as certain money laundering offenses; however, the current administration has not stated whether or not they will carry out these prosecutions.

Despite this announcement, many states remain eager to continue their pursuit to legalization – the Vermont legislature passed a bill to legalize the possession and growing of recreational marijuana in certain quantities and Republican Gov. Phil Scott is expected to sign the bill. Additionally, New Jersey Democratic Governor-elect Phil Murphy has promised to end the prohibition on marijuana in his state, likely through legislation, and Missouri lawmakers are currently considering two different pieces of legislation that would allow for state-legal marijuana programs. Michigan voters are expected to see a legalization question on the November ballot and a campaign for a legalization ballot question is also underway in Ohio. Both Delaware and Rhode Island have initiated task forces to analyze the feasibility of legalizing recreational marijuana in their respective states. Medical marijuana is already on the ballot for the June primary and the November election in Oklahoma and signatures are being gathered for a similar question in Missouri, South Dakota and Utah. Kentucky Democratic Secretary of State Alison Grimes is pushing for medical marijuana legalization through the legislature. Legislation and state activity surrounding recreational and medical legalization and the various related issues, including banking hurdles, will continue to be a hot topic of discussion and debate throughout 2018.